Today, I learned the meaning of unwinding, a trader’s term for fully exiting their positions in anticipation of upcoming events.

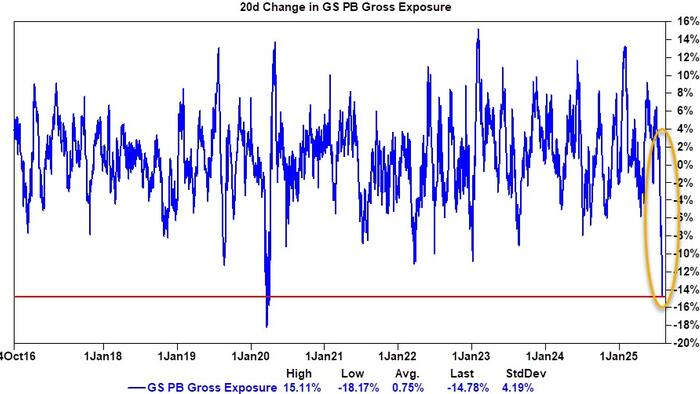

I want to explain what this chart means for regular folks because it’s actually a big warning signal that most people won’t understand. Hedge funds are reducing their market exposure at the fastest pace since the COVID crash, and this matters more than you might think.

What This Means in Plain English

When hedge funds “unwind gross exposure,” they’re essentially selling both their long positions (bets that stocks go up) and covering their short positions (bets that stocks go down). This means they’re stepping back from the market entirely, not just changing direction.

Why This Matters to You

Hedge funds are often the first to smell trouble because they have access to better information and faster data than retail investors. When they start pulling money out of markets this aggressively, it usually signals they expect significant volatility or downturns ahead.

The Timing Is Telling

This is happening right as we’re seeing weak jobs data, manufacturing contraction, housing market imbalances, and concerns about private credit bubbles. Hedge funds are essentially saying “we don’t want to be holding risk right now.”

What Usually Happens Next

When hedge funds reduce exposure this dramatically, it often precedes broader market selloffs. They’re not just repositioning, they’re de-risking entirely. This kind of wholesale retreat from markets typically happens when smart money sees trouble ahead.

For regular investors, this suggests being extra cautious about taking on new risk and maybe keeping more cash available for opportunities that emerge when markets get volatile. I hope this helps a bit to explain what we are seeing.

Source: X.com › Hedgie