These are my notes on a trading term, In-the-money ( ITM ).

In options trading, ITM means your contract has built-in (intrinsic) value. That means it’s worth something right now, even without future movement — whether you choose to exercise or sell the contract.

ChatGPT

Options Trading

An option is said to be “in the money” (ITM) when it has intrinsic value, meaning it would lead to a profit if exercised immediately.

- Call Option (right to buy) is in the money if:

- Stock price > Strike price

- Example: You have a call option to buy a stock at $50, and the stock is currently trading at $60. The option is $10 in the money.

- Put Option (right to sell) is in the money if:

- Stock price < Strike price

- Example: You have a put option to sell at $40, and the stock is trading at $30. The option is $10 in the money.

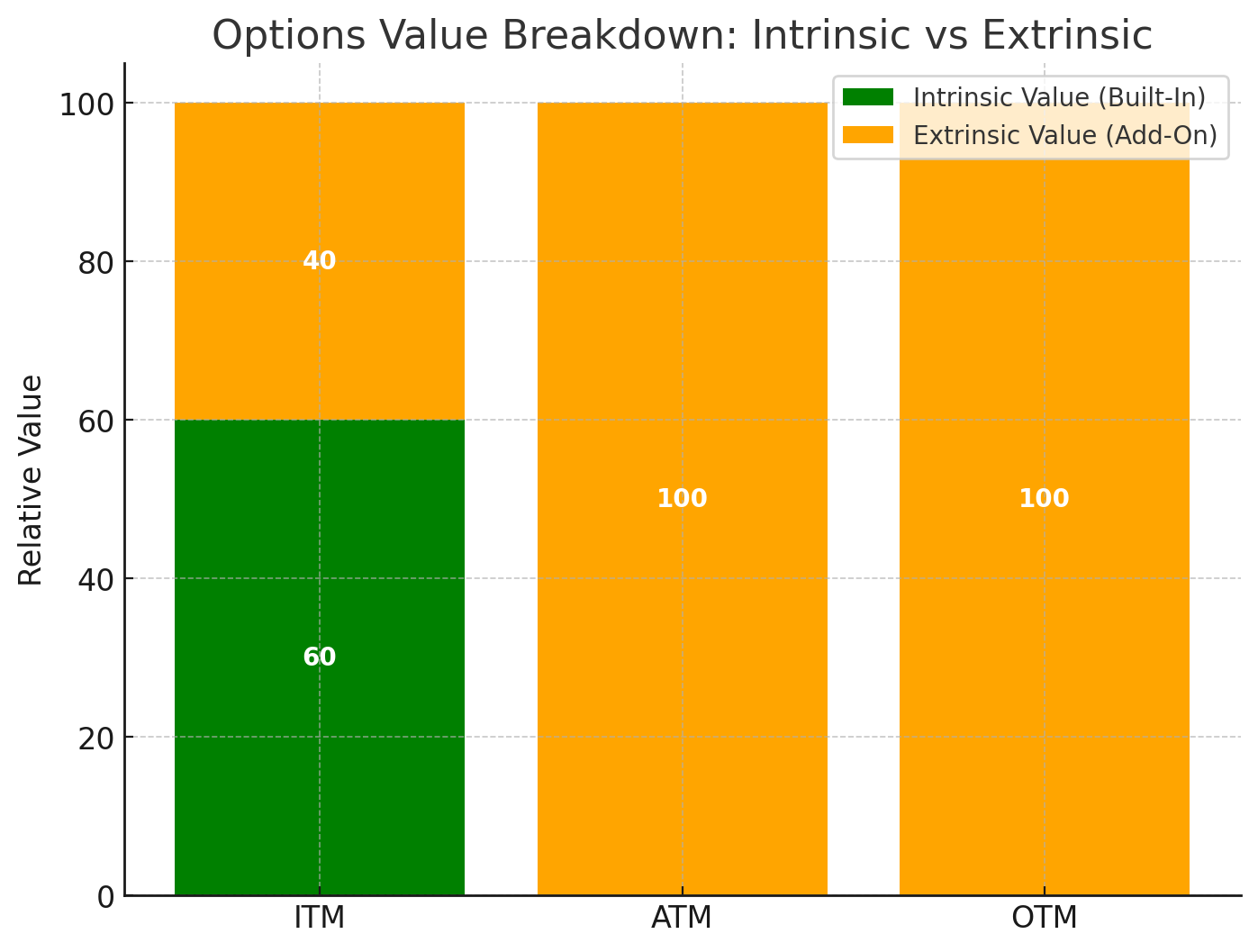

| Option Status | Stock vs Strike | Intrinsic Value (Built-In) | Extrinsic Value (Add-On) | What It Means |

|---|---|---|---|---|

| In the Money (ITM) | Favorable (e.g., stock above strike for calls, below strike for puts) | Yes → contract has built-in worth now | Still may have add-on value (time, volatility) | You could exercise or sell today and walk away with value |

| At the Money (ATM) | Stock price ≈ strike price | 0 (no built-in value) | 100% add-on value | All value is from time/volatility; needs movement to be profitable |

| Out of the Money (OTM) | Unfavorable (e.g., stock below strike for calls, above strike for puts) | 0 (no built-in value) | Only add-on value (time, volatility) | Worthless at expiration unless price moves into ITM |

Here’s a visual chart that breaks down option value into intrinsic (built-in, green) and extrinsic (add-on, orange):

- ITM: Has both intrinsic and extrinsic value.

- ATM: Only extrinsic value (no built-in).

- OTM: Only extrinsic value (no built-in).

Do you want me to also make a side-by-side diagram with a short caption under each (ITM, ATM, OTM) so you can use it as a quick teaching aid?