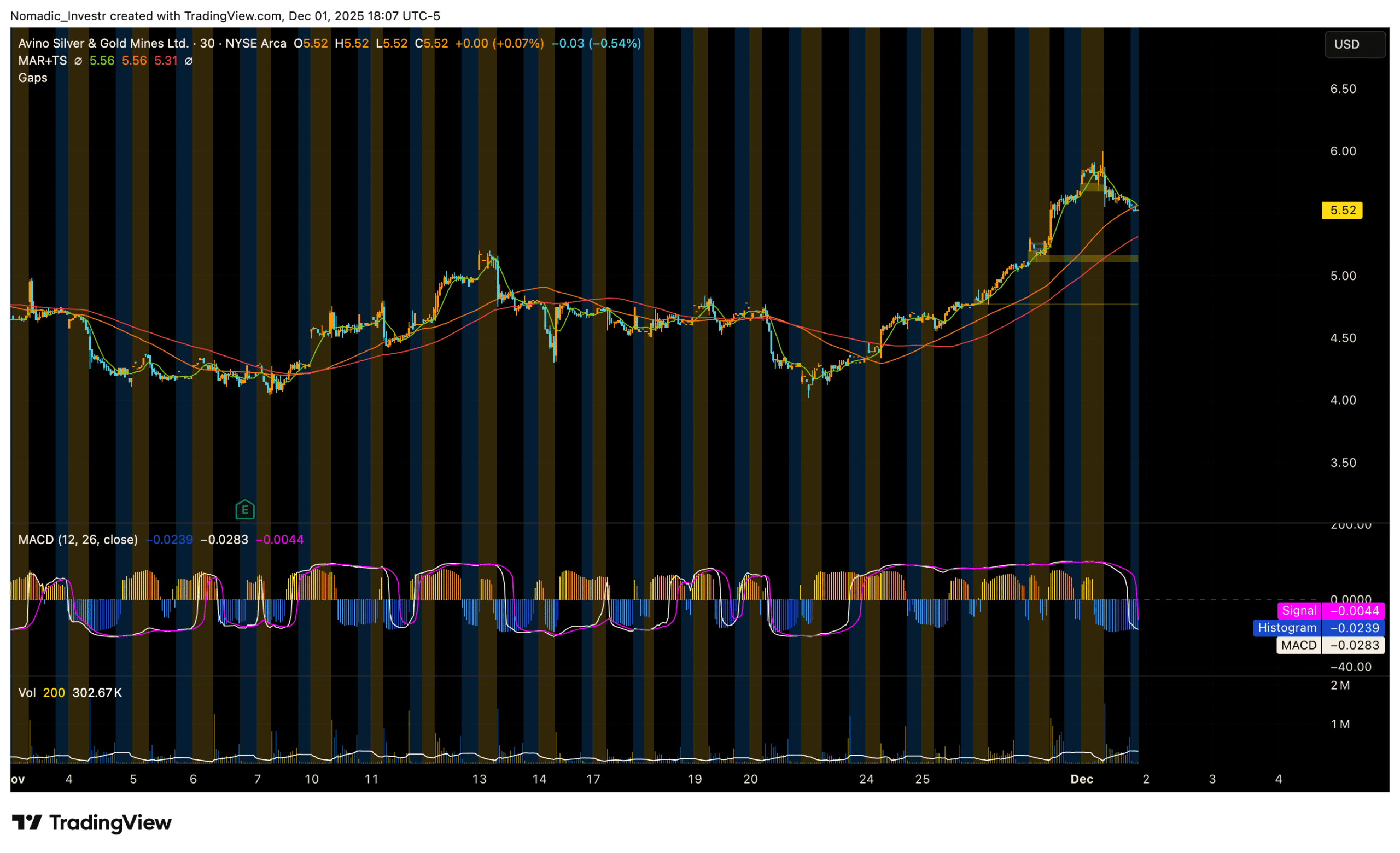

These are my notes on my closed position with Avino Silver & Gold Mines (ASM).

Brief notes about my entry

- Opened without stop-loss

- Willing to take the risk of going to zero

- Market context was full of fear and uncertainty surrounding interest rates and Trump’s economic policies

- Gap pattern

- Bearish gap zone serves as a resistance zone

- Stock gapped-up twice during extended holiday week-end

- 1st gap (overnight) during Friday’s shortened trading day

- 2nd gap (weekend) during Monday’s pre-market

- My intuition suggested if the market went down, it would try to fill the gap

Today, the market…

- Gapped up after two days of steady price increases

- Holiday week-end gap

- Cup-and-handle pattern

I forgot to…

- Check the 1-day, 1-minute chart for pre-market levels

- Price broke previous-day high-top

- Price re-touched pre-market low which became a resistance level

After exiting the position…

- I noticed a head-and-shoulder pattern on the 1-month time-frame, 30-minute interval chart

- Risk level seems to be increasing

- Could be temporary due to FOMC dot plot

- Risk level seems to be increasing